From Pre-Seed to IPO What Are the Startup Funding Stages

Table Of Contents

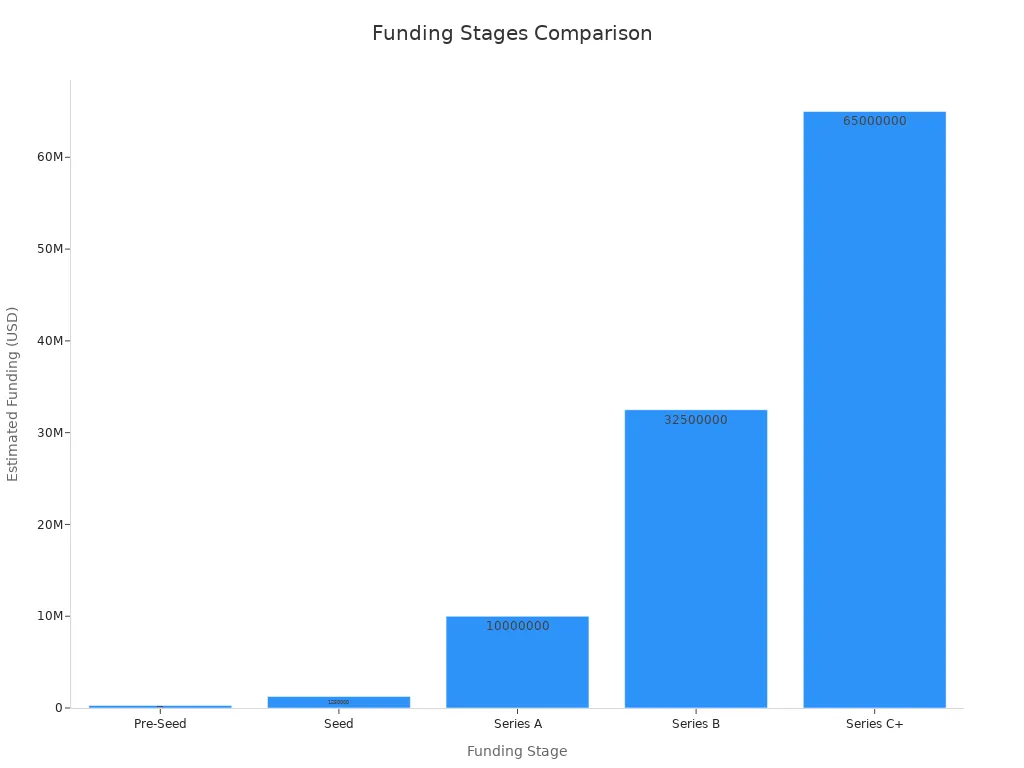

You begin your journey with bootstrapping. Next, you move through pre-seed, seed, Series A, Series B, Series C, and later rounds, ultimately aiming for an IPO. Each funding stage brings new investors and larger amounts of capital. As you progress, people expect more from your startup. Understanding these funding stages is crucial for raising money for startups and helps you avoid common mistakes. Nearly 29% of startups fail because they run out of money. The table below outlines the typical funding stages and amounts:

Funding Stage | Typical Funding Amounts | Main Investors |

|---|---|---|

Bootstrapping | Personal funds | Founders |

Pre-seed | $100k–$1M | Family, friends, angels |

Seed | $1M–$5M | Angels, micro-VCs |

Series A | $5M–$15M | VCs |

Series B | $50M–$110M+ | Late-stage VCs, hedge funds |

Series C | $50M+ | Private equity, corporate VCs |

IPO | Public market raise | Public investors |

By planning carefully at each stage, you improve your chances of successfully raising money for startups and achieving your business goals.

Key Takeaways

Begin your startup by bootstrapping. This helps you keep control. You also learn to handle money well.

Get pre-seed funds to make a prototype. Use this money to build your team. Show investors your idea can work.

Use seed funding to finish your product. Grow your users with this money. Prove your business can get bigger.

Series A, B, and C rounds give you more money. These help you grow fast. You can enter new markets. You also get ready for an IPO.

Plan your funding stages carefully. Build good relationships with investors. This helps you have long-term success.

Startup Funding Stages Overview

Bootstrapping and Pre-Funding

You begin with bootstrapping. You use your own money or savings. Sometimes, you ask family or friends for small loans. Bootstrapping lets you make a minimum viable product (MVP) and try out your idea. This stage gives you full control. It teaches you to be careful with money. Many founders use bootstrapping to keep more ownership. It also shows investors they can handle risk. Being careful with money early helps with future funding.

Pre-Seed Stage

The pre-seed stage comes after bootstrapping. Now, you look for your first outside money. You might get pre-seed funds from friends, family, angel investors, or micro-VCs. Pre-seed funding is usually between $50,000 and $500,000. Sometimes, it can be more. Investors at this stage care about your vision and team. They want to see a clear plan and proof your idea can work. Pre-seed money helps you build a prototype, do market research, and form your team. Pre-seed deals often use simple agreements like SAFEs or convertible notes. Showing early progress helps you raise more money later.

Seed Funding

Seed funding is the next step. At this stage, you raise money to finish your product. You also hire key people and test your business in the market. Seed funding amounts are bigger now, with deals around $4.6 million. Most startups at this stage have some revenue or users. Investors want to see real progress and a plan to grow. Seed money often comes from angel investors, micro-VCs, and early-stage venture capital firms. This stage helps you prove your idea works and get ready for series a funding.

Series A, B, and C

After seed funding, you move to series a, b, and c. Series a helps you grow your business, get more users, and make more money. Series a investors include accelerators and early-stage venture capital firms. Series a funding is usually between $1 million and $20 million. At this stage, you need strong growth and a plan to expand.

Series b funding is for bigger growth. You use series b to hire more people, enter new markets, and improve your product. Venture capital firms lead series b rounds, which are often $20 million to $30 million or more. Series b investors want to see your product fits the market and your business is growing.

Series c funding is for mature startups. You use series c to make big moves, like buying other companies or going international. Series c money often comes from private equity, hedge funds, or investment banks. These rounds can be very large, sometimes over $100 million. At this stage, you get ready for an IPO or another exit.

Later Stages and IPO

In the late stage, you focus on growing fast and getting ready for public markets. You might raise more money in extra rounds, like series d or e. You hire experienced leaders and set up strong money controls. When you reach the IPO stage, you file with the SEC and work with investment banks. An IPO lets you get money from the public and gives early investors a way to cash out. Some startups choose to be bought by a bigger company instead. Each funding stage builds on the last, helping you go from idea to public company.

Tip: Knowing the startup funding stages helps you plan each round and avoid mistakes when raising money.

Early Startup Funding

Bootstrapping

Bootstrapping means you start your business with your own money. You might use savings or money from your first customers. You do not rely on outside investors at this point. Many founders choose bootstrapping because it gives you full control over your company. You learn to spend carefully and focus on what matters most.

Most bootstrapped startups grow slowly but steadily. Research shows that bootstrapped SaaS companies below $1 million in annual revenue grow at a stable pace. They do not face the sharp drops that some venture capital-backed startups see during tough times. You focus on efficient sales and finding the right customers. This helps your company survive when the market gets hard.

Bootstrapping often happens in two steps. First, you use your own money or get help from family and friends. Next, you use money from your first customers to pay for costs. Only a small number of startups reach the seed stage or Series A. About 80% of startups fail before they get there. This shows how hard the early stage can be.

You need to track key numbers, like how much it costs to get a customer and how much money each customer brings in. For example, the founder of Le Tote focused on these numbers to improve profits and attract investors later. If you master these skills early, you set a strong base for future startup funding rounds.

Note: Bootstrapping teaches you discipline and helps you build a business that can last. It also makes your company more attractive to investors in later rounds.

Pre-Seed

The pre-seed stage comes after bootstrapping. At this point, you look for your first outside investment. You might raise money from friends, family, angel investors, or even through crowdfunding. The pre-seed round usually brings in small amounts, from a few thousand dollars up to $500,000. In some places, like Silicon Valley, the pre-seed round can be as high as $750,000.

You use pre-seed funding to test your idea and build a simple version of your product, called a minimum viable product (MVP). You also start to form your team and look for your first customers. The main goal is to show that your idea can work in the real world.

Here is a quick look at what happens during the pre-seed stage:

You build a prototype or MVP.

You test your product with early users.

You hire your first team members.

You start to build partnerships.

Investors at the pre-seed stage want to see a strong team and a clear problem you are solving. They do not expect big sales yet. They want to know you can turn your idea into something real. Most pre-seed rounds use simple agreements, like convertible notes or SAFEs, instead of selling shares right away.

The pre-seed stage is important because it helps you move from an idea to a real product. If you reach your goals here, you can attract more startup funding in the seed stage.

Tip: Focus on building a good team and showing that people want your product. This will help you stand out in the next round of raising money for startups.

Seed Funding

Seed funding is the next big step for your startup. You use this money to finish your product, hire more people, and start growing your business. The seed stage is when you try to prove that your company can grow and make money.

Seed funding rounds are bigger than pre-seed rounds. You might raise between $1 million and $3 million, but some companies raise even more. For example, Gong raised $6 million and OpenSea raised $2 million in their seed rounds. Investors in the seed stage include angel investors, seed venture capital firms, and sometimes larger seed funds.

Here is a table to help you compare the pre-seed and seed stage:

Aspect | Pre-seed Funding | Seed Funding |

|---|---|---|

Typical Amount | $50,000 – $500,000 | $1 million – $3 million |

Company Stage | Early prototype | MVP with early traction |

Main Goal | Idea validation, MVP | Product-market fit, growth |

Key Metrics | Team, problem validation | User growth, revenue |

Investor Types | Angels, friends/family | Seed VCs, angel syndicates |

Valuation | $1M – $3M | $5M – $10M |

During the seed stage, you need to show that people want your product. You should have some users or early sales. Investors want to see that your company can grow fast. They look for signs that you can reach a bigger market.

You use seed funding to:

Improve your product.

Grow your team.

Start marketing and sales.

Get more customers.

Investors expect you to have a clear plan for growth. They want to see that you can use their money wisely. Most seed funding deals use convertible notes or priced equity. You should only raise as much as you need. Raising too much can make it harder to get more startup funding later.

The seed stage sets the foundation for future rounds, like Series A. If you do well here, you can attract bigger venture capital firms and keep growing.

Remember: The early stage is tough, but it helps you build the skills and track record you need for later success.

Growth and Expansion Rounds

Series A

Series A is the first big growth step. You use this round to turn your product into a growing business. By now, people want your product. You have some money coming in and many users. Investors want to see you can grow fast and make money.

Series A funding is usually between $2 million and $15 million. Sometimes, it can be as high as $23 million. Venture capital firms lead most Series A rounds. Angel investors and early-stage funds sometimes join too. You give up about 20% to 35% of your company for this money.

You must show clear growth. Investors check numbers like customer acquisition cost, lifetime value, and monthly revenue growth. Many startups at this stage grow revenue by 10% or more each month. You should also have at least six months of cash left.

To get ready for Series A, you organize your financial records. You build good relationships with investors. You make a strong pitch to show your business can grow bigger. You focus on product-market fit and show your company can lead its market.

Tip: Series A is about showing you can turn a good idea into a fast-growing business. Show investors you know your numbers and have a plan to grow.

Series B

Series B is the next fundraising step. You use this round to grow your business and reach more customers. Now, you have a working business model and steady money coming in. Series B helps you hire more people, go into new markets, and make your product better.

Series B funding is often around $32.6 million. Venture capital firms lead these rounds. Late-stage investors may join too. Investors want to see you can grow without spending too much. They look for strong revenue growth, happy customers, and a team that can handle bigger problems.

You must show your business can get bigger. Investors check things like annual recurring revenue, gross margin, and net revenue retention. For example, Snowflake kept a net revenue retention above 160%. This showed strong customer growth and market reach. You also need to prove you can enter new markets or add new products. Facebook used Series B money to grow past college students and beat Myspace.

Here is a table that shows what investors look for in Series B:

Metric | Description/Role in Series B Evaluation |

|---|---|

Shows steady revenue increase, key for scaling | |

Gross Margin | Reflects profit potential and efficiency |

Annual Recurring Revenue (ARR) | Basis for valuation, shows stable income streams |

Net Revenue Retention (NRR) | Measures customer retention and expansion, critical for growth |

Customer Acquisition Cost (CAC) | Checks efficiency in getting new customers |

Customer Lifetime Value (LTV) | Estimates long-term revenue per customer |

You use Series B to make your product better and reach new users. Some companies add features, like Stripe adding fraud prevention and analytics. Others go into new markets, like Snowflake moving from data warehousing to data science.

Note: Series B is about growing what works. Show you can grow fast, keep customers happy, and manage your team as you get bigger.

Series C and Beyond

Series C and later rounds help you become a leader. You use these rounds to go into new countries, buy other companies, or launch new products. Series C funding often brings in $50 million or more. Private equity firms, hedge funds, and corporate investors join at this stage. These investors want to see strong revenue and a clear path to making money.

Only about 7% of startups that raise seed money reach Series C. This shows how hard it is to get this far. You must show steady revenue growth and strong financial health. Investors expect you to manage numbers like year-over-year revenue growth, gross margin, and customer acquisition cost. A gross margin above 75% is common at this stage.

Here are some key points about Series C and beyond:

Series C helps you grow faster, go into new markets, and get closer to making a profit.

Investors include big venture capital firms, private equity, and corporate funds.

Later rounds (Series D, E, F) focus on being the top company and getting ready for IPO or exit.

Each round helps you run bigger operations and reach more people.

For example, Uber used Series C money to grow worldwide and add new services.

You also need to build strong teams and systems. Your company moves from random processes to repeatable ones. You focus on managing people, data, and tools to help growth. Series C and later rounds help you get ready for an IPO by improving your financial reports and profits.

Tip: Series C and beyond are for companies ready to lead their market. Show you can handle big growth and get ready to be a public company.

Bridge and Venture Debt Rounds

Sometimes, you need extra money between big fundraising rounds. Bridge rounds and venture debt help you manage your cash and reach important goals. Bridge rounds give you short-term money, often through convertible notes or debt. You use this money to finish a product, sign a big customer, or get ready for your next round.

Venture debt lets you borrow money without giving up more ownership right away. This helps you have more time and reach higher value before your next equity round. Venture debt is good when you want to grow fast and stay ahead of others.

Here are some ways bridge and venture debt rounds help you:

Bridge rounds give you short-term money and delay valuation, so you avoid losing ownership right away.

You use these rounds to reach important goals that make your company worth more.

Key terms include valuation caps, discount rates, and interest rates, which affect how much ownership you give up later.

Venture debt gives you more time and makes investors more confident.

Using these tools well helps you keep growing and get better deals in future rounds.

Note: Bridge and venture debt rounds give you flexibility. Use them to manage timing and money needs, but be careful of high interest rates or losing ownership.

IPO and Exit Strategies

IPO

An Initial Public Offering (IPO) lets you sell company shares to the public for the first time. Many founders think an IPO is the best way to exit. You can get a lot of money and make your company look more trustworthy. Early investors can also get their money back. IPOs often have higher values than acquisitions because public investors pay more for growth. When the market is strong, IPOs can give returns almost six times bigger than mergers or acquisitions.

To do well with an IPO, your company needs strong money results. Investors check your yearly revenue growth, gross margin, and net dollar retention. The Rule of 40 is important. It adds your growth rate and profit margin together. Companies like Klaviyo and Instacart showed good profits and size before going public. You also need to follow strict rules and share detailed money reports. The market will watch your company closely. IPOs need about six times more money and more funding rounds than acquisitions. You should have a strong leadership team and keep your business running well during this time.

Tip: Grow your company in a smart way and keep your money records clear. This will help you get investors and handle being a public company.

Other Exit Options

Not every startup picks an IPO. There are other ways to exit:

Acquisition: A bigger company buys your startup. This is the most common exit. It is faster and more certain, but usually has a lower value.

Management Buyout (MBO): Your leaders buy the company. This keeps control with your team and helps the business stay the same.

Employee Stock Ownership Plan (ESOP): You give ownership to employees. This can make workers happier and give tax benefits.

Secondary Sales: Early investors or workers sell their shares to new investors. This gives them cash without a full exit.

Liquidation: You sell company assets to pay debts if you cannot exit another way.

The right exit depends on how ready your company is, the market, and what investors want. Tools like Crunchbase and PitchBook help you watch exit trends and make smart choices. Acquisitions are quick and give you more control. IPOs give higher returns and more attention. You should think about the pros and cons and get your team ready for your choice.

Note: The best exit plan fits your business goals, team, and market timing. Always plan ahead to get the best result.

Stages of Startup Funding Comparison

Quick Reference Table

You need a clear way to compare each startup funding stage. This table helps you see the main differences between pre-seed, seed, series a, series b, and series c funding. You can use it to plan your next steps and understand what investors want at each stage.

Funding Stage | Typical Funding Amounts | Key Investor Types | Main Goals and Milestones |

|---|---|---|---|

Pre-seed | $50,000 – $500,000 | Friends & Family, Angel Investors, Pre-seed Funds | Build MVP, validate market, form team |

Seed | Angels, Seed VCs, Accelerators | Product-market fit, early users, refine product | |

Series A | Venture Capital Firms, some Angels | Scale business, grow revenue, prove demand | |

Series B | $15,000,000 – $50,000,000 | Larger VCs, Corporate Funds, Private Equity | Expand markets, hire teams, show profit path |

Series C Funding | $30,000,000 – $100,000,000+ | Late-stage VCs, Private Equity, Hedge Funds | Aggressive growth, global expansion, prep for IPO |

You start with pre-seed. At this stage, you focus on building your first product and testing your idea. Investors want to see a strong team and a clear problem. When you move to seed, you show that people want your product. You use the money to get more users and improve your offer.

Series a is a big step. You need to prove your business can grow fast. Investors look for real revenue and a plan to scale. Series a funding is much larger than pre-seed or seed. You must show strong numbers and a clear market.

Series b comes next. You use this round to reach more customers and enter new markets. Investors want to see that you can grow without wasting money. Series b is about building a bigger team and making your business stronger.

Series c funding helps you become a leader. You use this money for big moves, like buying other companies or going global. Investors expect you to have strong profits and a clear plan for an IPO or exit.

Tip: As you move from pre-seed to series a, series b, and series c funding, the money gets bigger and the goals get harder. You must show more proof that your business works at each step.

Here is a chart that shows how funding amounts grow at each stage:

You can see that pre-seed and seed rounds are much smaller than series a. Series b and series c funding bring in much more money. Each stage has new investor types and higher expectations. You need to track your progress and get ready for the next round.

Understanding each funding stage helps you meet investor expectations and reach key milestones. As you move from Seed to Series C, you show product-market fit, steady revenue, and a plan for growth. Use this knowledge to check your current stage and set clear goals. Start building strong investor relationships and prepare for your next round. Every step you take brings you closer to long-term success. 🚀

FAQ

What is the difference between seed and Series A funding?

Seed funding helps you build your product and find your first customers. Series A funding helps you grow your business and reach more users. You need to show more proof of growth for Series A.

How do you know when your startup is ready for Series B?

You know you are ready for Series B when you have steady revenue, happy customers, and a strong team. Investors want to see that your business can grow bigger and faster.

Can you skip a funding stage?

You can sometimes skip a stage if your startup grows quickly or attracts big investors early. Most startups follow each stage to build a strong foundation and meet investor expectations.

Who invests in pre-seed rounds?

You often get pre-seed money from friends, family, or angel investors. Some small funds also invest at this stage. These investors believe in your idea and your team.